What is Term Insurance: We got information about life insurance and Health Insurance

this term insurance is also as important as Life Insurance. Both get the same sum insured. But there is a huge difference between the two.

So let us know about the same in detail. It covers life till the person reaches 99 years. Let us understand more information about it in detail.

What is Term Insurance?

Like life insurance covers our life. Similarly, also informs our life. The only difference in this is the premium we pay on life insurance.

We have to pay many fewer premiums than that. And we also get a huge amount of money. Term insurance is a great way of providing protection to family members to avoid financial troubles when the person insured is no more.

Along with this, it has more coverage area. which are received by the insured.

- What do you mean by insurance

- How to Choose the Right Health Insurance

- Personal Finance from College to Career

Term insurance is a type of life insurance that gives financial protection for a specific period.

If the insured person passes away during this time, the company pays a death benefit to the beneficiary.

Understanding the key features of term insurance and its importance is crucial before purchasing it.

The goal of life insurance is to offer coverage to the policyholder and ensure financial security for their family.

Life insurance can be obtained in two ways:

Choosing pure life cover, known as term insurance.

Opting for life cover with a savings component, also called endowment insurance.

Why Term Insurance is better?

Term insurance is advantageous for several reasons. Firstly, it offers pure life coverage without any savings or profit component.

This simplicity makes term plans more cost-effective compared to other alternatives.

Policyholders can secure a larger life cover at a lower premium in comparison to similar endowment plans.

In essence, term insurance prioritizes providing essential life protection at an affordable rate.

key features

1. Larger Life Cover: Affordability of term life insurance allows for a higher life cover compared to endowment plans.

2. Riders: Additional riders, such as critical illness or disability cover, enhance the utility of the term plan based on specific needs.

3. Enhanced Cover: Flexibility to increase life insurance coverage at critical life stages, adapting to changing responsibilities.

4. Innovative Features: Insurance companies offer innovative features, like premium discounts for non-smokers, and the convenience of online purchases.

5. Tax Benefits: Tax exemptions under section 10(10D) of the Income Tax Act make term insurance a tax-efficient investment.

6. Multiple Payout Options: Flexibility in choosing the frequency of payouts (monthly, quarterly, or annually) based on the policyholder’s convenience.

7. Premium Waiver: Premium waiver benefit in exceptional conditions, such as permanent disability due to an accident, provided all previous premiums have been paid.

Who should buy Term Insurance plans?

Term insurance plans are for everyone. They offer life coverage with affordable premiums for both business people and salaried employees.

These plans are a great way to protect against life uncertainties at any age. If you’re in your 20s, it’s wise to start with a plan that provides high coverage for a low premium.

In your 30s, with growing families and more responsibilities, it helps protect against financial uncertainties.

Even in your late 40s and 50s, term insurance can offer enough coverage for responsibilities like children’s education and weddings, while also helping you plan for retirement.

1. Financial Security Against Uncertainties:

Term insurance plans act as a robust shield against uncertainties, ensuring the financial well-being of your family.

Affordable premiums allow you to secure substantial coverage, providing a foundation for a worry-free future for your loved ones.

2. Enhanced Coverage through Add-on Riders:

The incorporation of add-on riders, such as the Accidental Death and Dismemberment Rider and the Waiver of Premium Plus Rider, involves an additional cost but brings significant benefits.

These riders contribute to comprehensive coverage, adding an extra layer of security and peace of mind.

3. Critical Illness Coverage:

Recognizing the potential impact of critical illnesses, even in one’s 20s and 30s, it is advisable to consider adding a critical illness rider to your term insurance plan.

This supplemental coverage offers crucial financial support in case of covered illnesses, preserving your savings.

4. Protection from Accidental Death or Disability:

Term insurance plays a pivotal role in shielding against the financial implications of unforeseen accidents.

Swiftly securing an accidental death or disability rider ensures comprehensive coverage for accidental dismemberment and death.

5. Tax Benefits :

Term insurance plans provide tax relief of up to Rs. 1.5 lakh under Section 80C.

Additionally, critical illness covers offer extra tax benefits under Section 80D, enhancing the overall financial advantage.

6. Versatile Payout Options:

Term insurance plans offer flexibility with multiple payout options.

This feature allows your family to receive financial assistance in a structured manner tailored to meet their specific needs during unexpected situations.

Types of Term Insurance in India

Term insurance has gained popularity in India as a cost-effective life insurance option, providing financial security for policyholders and their families.

Various types of term insurance policies cater to the diverse needs of Indian consumers.

1. Level Term Insurance:

- The most common type, offering a fixed sum assured throughout the policy’s duration.

- Provides a predictable cost structure with constant premiums.

2. Increasing Term Insurance:

- Sum assured gradually increases over the policy term to combat the effects of inflation.

- Slightly higher premiums than level term insurance, offering protection against rising living costs.

3. Decreasing Term Insurance:

- Tailored for individuals with specific financial obligations, such as loans.

- Sum assured decreases over time, aligning with decreasing financial obligations, while premiums remain constant.

4. Term Insurance with Return of Premium (TROP):

- If the policyholder survives the term, total premiums paid are refunded.

- Higher premiums compared to traditional term plans, but with a savings component, making it an attractive option for some.

5. Convertible Term Insurance:

- Offers adaptability, allowing policyholders to convert their term policy into an endowment or whole life policy later.

- Ideal for individuals whose needs may evolve over time, providing flexibility.

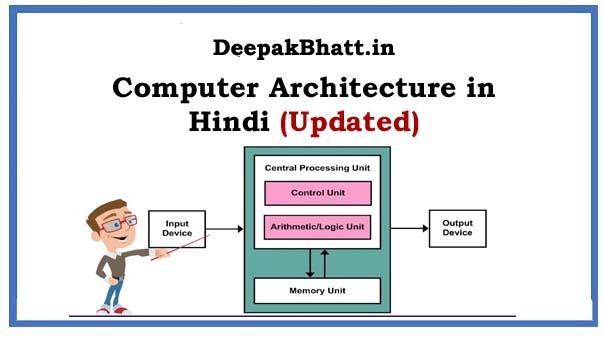

How Term Life Insurance Operates

Level term policies, commonly known as “level term” policies, involve fixed premiums for specific durations, such as 10, 20, or 30 years.

Insurance companies charge policyholders a regular premium, usually paid monthly, to grant them entitled benefits.

Premium calculations consider factors like health, age, and life expectancy. Depending on the chosen policy, a medical exam might be required based on your health and family medical history.

Typically, premiums remain fixed and are paid throughout the term. If the insured person passes away before the policy expires, the insurance company disburses the death benefit to the beneficiaries.

However, once the term concludes, there is no coverage or payout if the individual passes away afterward.

Renewal or extension of the insurance is possible, but the new monthly premium is determined by the person’s age at the time of renewal.

Many term life insurance policies offer convertibility, allowing conversion into permanent life insurance within a specified period.

It’s important to note that premiums increase when converting from term life insurance to permanent life insurance.

This flexibility provides policyholders with options to adapt their coverage to changing life circumstances.

What are the benefits of investing?

It is one such plan. Where you can save your entire family from being deprived of financial security. Because of this, we have to pay a small premium.

And if any event happens in the future. So we get the most money. So let’s know. What a significant benefit we can get from getting this done. And how suitable and ambitious it is for us.

The family members of the insured get Financial Assistance

Have we thought? What if we are not there then who will bear the cost of our whole house? If we are bearing the full cost of tax. And in the meantime, if we walk from this whole world, then term insurance helps us. And it provides financial security to our family members. Which is a benefit to our family after we are gone. That they get money to do something and to make a living.

To protect the future of Children

Term insurance is not a protection in itself, it is the condition our family members will have to bear in case of a future event. That state is done to provide security. Along with this, it is also necessary to fulfill the goals of family members and children in the future. After the death of the insured, term insurance helps him in achieving the entire goal.

To avoid tax

We can also get term insurance to save tax. Because when we invest money in it. Then we do not have to pay much tax and we also get term insurance. So we can avail of tax benefits from here.

Get big Money with low premium

Term insurance is the only insurance that charges the lowest premium. For this, we do not have to pay much premium. But later when we get the full amount with a premium then we get a huge amount. Therefore, it is the plan with the lowest premium.

Easy to Claim

We do not have to put in much effort to claim this and this term insurance also makes us claim payments. There are no problems with this and the rejection stage is also less.

If we follow its policy and rules then we will not have a problem getting claim payment. And we will easily get full income with premium.

We just have to read the policy documents carefully while getting term insurance. And we have to get accurate information. Do not give wrong information at all so that we do not face any problems in the future.

How much do we need to be eligible to get Term Insurance?

There are not many criteria set for getting term insurance. According to these criteria, our age should be between 18 to 70 years. And with this, our minimum income should be up to 200000.

And the working period of term insurance ranges from 5 years to 50 years. In this, the age of the insured who reaches the maturity stage is from 80 years to 100 years. And in this, we get more than 25 crores. If we don’t survive.

What facility do we get in Term Insurance?

Term insurance is term life insurance. In which we get many facilities. Let us read and understand all those facilities in detail.

We do not face any problem in choosing the premium amount under term insurance. We can choose the amount according to our own. that lasts till maturity

There is no fixed minimum investment under term insurance. We can start with as low as ₹10 as per our requirement. That’s why term insurance is considered the cheapest.

The term insurance company covers us for life. This company provides insurance till the age of 100 years. So in such a situation, the person is not able to survive so much at the present time. So this is the best slow duration.

Under term insurance, if you are of any age, how much premium do you have to pay you? You can filter according to his age, it gives you a chance. And at the same time, the shorter the tenure, the lesser you will have to pay the premium. And in this, you can put the period for which you will pay the premium.

You can get an assured return along with a premium in three stages. Like you get if you get into an accident. Even if you get sick, you get it. Or even if you die, you still get it.

Conclusion

Hope you have got the information about term insurance. You can get term insurance and here you must have come to know about it. What can be the difference between health insurance & life insurance and term insurance?

And which is the best among these three, with this, if you like the information given in the post, then definitely share it with your friends. Share on social media and stay tuned for our upcoming posts.

FAQs about Term Insurance

1. Who is eligible for term insurance?

In most cases, individuals aged 18 or above can obtain a term insurance policy, with a maximum age limit typically up to 65 years.

Specific eligibility criteria may vary, so it’s advisable to check with your chosen insurance provider.

2. What factors affect the term insurance premium?

Before determining your premium, your insurance provider considers factors such as age, gender, medical history, location, occupation, lifestyle, and more.

3. Can I buy term insurance for a spouse?

Yes, you can opt for this option. Joint-term insurance plans are available, providing coverage for both you and your spouse under the same policy.

4. How much term insurance do I need?

As a general guideline, the sum assured should be a minimum of 10 times your annual income. Choosing a higher range is even better.

However, individual needs and preferences should also influence your decision.

5. What are the minimum and maximum ages to buy a term insurance policy?

Term insurance policies can typically be purchased between the ages of 18 and 65. Some insurance companies may offer plans to older individuals, so there can be exceptions.

6. What is a term insurance rider?

A rider is an additional benefit that a policyholder can choose to add to their selected policy.

Riders provide added assurance in case of accidents, permanent disability, or critical illnesses, enhancing the coverage of the primary policy.

Welcome all of you to my website. I keep updating posts related to blogging, online earning and other categories. Here you will get to read very good posts. From where you can increase a lot of knowledge. You can connect with us through our website and social media. Thank you