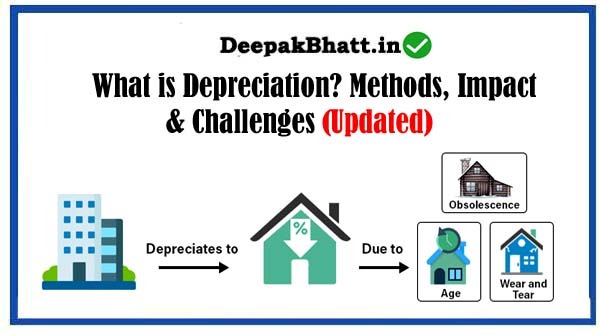

What is Depreciation: An accounting method used to allocate the cost of tangible assets over their useful lives.

In simpler terms, it represents the gradual decrease in the value of an asset due to wear and tear, obsolescence, or the passage of time.

Depreciation is not a cash outflow; rather, it is a non-cash expense that reflects the reduction in the asset’s value over time.

What is Market Capitalization?

- 1 The Rationale Behind Depreciation (What is Depreciation?)

- 1.1 1. Matching Principle:

- 1.2 2. Asset Valuation:

- 1.3 3. Tax Deduction:

- 1.4 4. Decision-Making:

- 1.5 Methods of Depreciation

- 1.6 1. Straight-Line Depreciation:

- 1.7 2. Declining Balance Depreciation:

- 1.8 3. Units of Production Depreciation:

- 1.9 4. Sum-of-the-Years-Digits Depreciation:

- 1.10 5. Double Declining Balance Depreciation:

- 1.11 Impact on Financial Statements

- 1.12 1. Income Statement:

- 1.13 2. Balance Sheet:

- 1.14 3. Cash Flow Statement:

- 1.15 Real-World Applications and Examples

- 1.16 1. Real Estate:

- 1.17 2. Vehicles:

- 1.18 3. Machinery and Equipment:

- 1.19 4. Intangible Assets:

- 1.20 Challenges and Considerations

- 1.21 1. Estimating Useful Life:

- 1.22 2. Residual Value:

- 1.23 3. Book Value vs. Market Value:

- 1.24 4. Regulatory Changes:

- 1.25 Future Trends in Depreciation

- 1.26 1. Technology Integration:

- 1.27 2. Sustainability Considerations:

- 1.28 3. Standardization and Global Harmonization:

- 1.29 Conclusion

The Rationale Behind Depreciation (What is Depreciation?)

Depreciation serves several critical purposes in the realm of accounting and financial reporting:

1. Matching Principle:

The matching principle is a fundamental accounting concept that aims to align expenses with the revenue they generate. Depreciation allows businesses to spread the cost of an asset over its useful life, matching the expense with the periods in which the asset contributes to revenue generation.

2. Asset Valuation:

Depreciation helps in maintaining accurate and realistic values for assets on the balance sheet. As assets age and lose value, reflecting this decline in their book value provides a more accurate representation of their economic worth.

3. Tax Deduction:

Businesses can often claim tax deductions for depreciation expenses, providing a tangible benefit in terms of reducing taxable income. Various tax authorities have specific rules and methods for calculating depreciation.

4. Decision-Making:

Accurate depreciation figures are essential for informed decision-making. Businesses rely on the depreciation of assets to assess when it might be more cost-effective to replace or upgrade equipment rather than continuing to maintain older assets.

Methods of Depreciation

Several methods exist for calculating depreciation, each with its own set of assumptions and implications. Some of the commonly used methods include:

1. Straight-Line Depreciation:

The straight-line method allocates an equal amount of depreciation expense each year over the asset’s useful life. It is straightforward and easy to calculate, making it a popular choice for its simplicity.

2. Declining Balance Depreciation:

- Also known as the reducing balance method, this approach allocates a higher depreciation expense in the earlier years of an asset’s life and gradually decreases it over time. It reflects the idea that assets often lose more value in their earlier years.

3. Units of Production Depreciation:

This method ties the depreciation expense to the actual usage of the asset. The more an asset is used, the higher the depreciation expense. It is particularly suitable for assets where usage is a more accurate measure of wear and tear.

4. Sum-of-the-Years-Digits Depreciation:

This method considers the sum of the digits of an asset’s useful life as the denominator for calculating depreciation. It results in a higher depreciation expense in the earlier years, gradually decreasing over time.

5. Double Declining Balance Depreciation:

This is an accelerated depreciation method that doubles the straight-line rate and applies it to the asset’s book value. While it frontloads depreciation expenses, it results in lower expenses in later years.

Impact on Financial Statements

Depreciation has a direct impact on a company’s financial statements, influencing both the income statement and the balance sheet:

1. Income Statement:

On the income statement, depreciation is reported as an expense. This reduces the reported profit, aligning with the matching principle. The reduction in profit can have tax implications, affecting the amount of taxable income.

2. Balance Sheet:

On the balance sheet, depreciation is reflected in the accumulated depreciation account, which is subtracted from the asset’s original cost to determine its net book value. As assets age, the accumulated depreciation increases, indicating the total depreciation recognized over the asset’s life.

3. Cash Flow Statement:

While depreciation is a non-cash expense, it is added back to the operating cash flow section of the cash flow statement. This adjustment helps reconcile non-cash expenses to cash flows generated by operating activities.

Basics of Personal Finance: Getting Started on the Right Foot

A Personal Finance Guide Tutorials for Free

Learn Personal Finance 101 Free Video Course

Real-World Applications and Examples

1. Real Estate:

Real estate assets, such as buildings, are subject to depreciation. The straight-line method is often applied, spreading the cost of the building evenly over its estimated useful life, which may be several decades.

2. Vehicles:

Companies that own fleets of vehicles often use accelerated depreciation methods, reflecting the higher wear and tear that occurs in the initial years of a vehicle’s life.

3. Machinery and Equipment:

Industrial machinery and equipment depreciate over time due to usage and technological advancements. Businesses may use various methods depending on the nature of the assets.

4. Intangible Assets:

Depreciation is not limited to tangible assets. Intangible assets, such as patents and copyrights, are amortized over their useful lives, applying similar principles to tangible asset depreciation.

Challenges and Considerations

While depreciation is a standard accounting practice, there are challenges and considerations that businesses must navigate:

1. Estimating Useful Life:

Determining the useful life of an asset involves judgment and estimation. Changes in technology or unexpected wear and tear can challenge the accuracy of these estimates.

2. Residual Value:

Residual value is the estimated value an asset will have at the end of its useful life. Accurate estimation is crucial for calculating depreciation, and changes in market conditions can impact residual value.

3. Book Value vs. Market Value:

The book value of an asset (original cost minus accumulated depreciation) may differ from its market value. This difference can impact financial ratios and decision-making.

4. Regulatory Changes:

Tax regulations and accounting standards may change, impacting the rules for calculating and reporting depreciation. Businesses must stay informed to ensure compliance.

Future Trends in Depreciation

1. Technology Integration:

Advancements in technology, including the use of artificial intelligence and machine learning, may enhance the accuracy of estimating useful lives and predicting asset values, influencing how depreciation is calculated.

2. Sustainability Considerations:

Businesses are increasingly focusing on sustainability. Depreciation methods may evolve to incorporate environmental factors, reflecting the impact of assets on sustainability goals.

3. Standardization and Global Harmonization:

Efforts toward global accounting standards may lead to greater standardization in depreciation practices across different regions, improving comparability for investors.

Conclusion

In conclusion, depreciation is a fundamental concept in accounting, serving as a bridge between the tangible assets a company owns and the financial statements that communicate its financial health.

Understanding depreciation is essential for accurate financial reporting, tax compliance, and strategic decision-making.

As businesses navigate the complexities of asset management, depreciation remains a key tool in their accounting arsenal.