Discretionary Income In the realm of personal finance, Plays a crucial role in shaping individuals’ lifestyles and choices.

This comprehensive guide aims to provide insights into what discretionary income is, how it is calculated, and its significance in personal financial management.

- 1 Discretionary Income

- 1.1 1. Definition:

- 1.2 2. Key Characteristics:

- 1.3 II. Calculating

- 1.4 1. Identifying Essential Expenses:

- 1.5 2. Subtracting Essential Expenses:

- 1.6 3. Consideration of Debt Payments:

- 1.7 III. Significance of Discretionary Income

- 1.8 1. Financial Flexibility:

- 1.9 2. Quality of Life:

- 1.10 3. Economic Indicator:

- 1.11 IV. Managing Discretionary Income

- 1.12 1. Budgeting:

- 1.13 2. Emergency Fund:

- 1.14 3. Investing:

- 1.15 V. Challenges and Considerations

- 1.16 1. Fluctuations in Income:

- 1.17 2. Changing Priorities:

- 1.18 VI. Economic Impact of Discretionary Income

- 1.19 1. Consumer Spending:

- 1.20 2. Business Strategies:

- 1.21 VII. Conclusion

Discretionary Income

1. Definition:

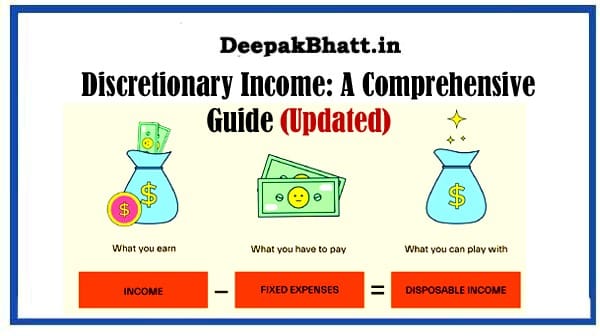

It is the amount of money individuals have available after deducting essential living expenses such as taxes, rent or mortgage, utilities, and food from their total income. It represents the funds that can be spent or saved at the individual’s discretion.

2. Key Characteristics:

It is not fixed and can vary based on individual circumstances. It provides financial flexibility for non-essential spending or saving.

II. Calculating

1. Identifying Essential Expenses:

Begin by determining fixed and necessary expenses, including rent or mortgage, utilities, insurance, taxes, and groceries.

2. Subtracting Essential Expenses:

Subtract the total of these essential expenses from the individual’s total income. The remaining amount is the discretionary income.

3. Consideration of Debt Payments:

Depending on the financial situation, debt payments such as loans or credit card bills may be factored into essential expenses.

III. Significance of Discretionary Income

1. Financial Flexibility:

It’s provides individuals with the freedom to make choices about how they use their remaining funds, whether for leisure, entertainment, travel, or savings.

2. Quality of Life:

The income level often directly impacts an individual’s quality of life. Higher income allows for a more comfortable and enjoyable lifestyle.

3. Economic Indicator:

On a broader scale, discretionary income is an economic indicator. Changes in discretionary income can reflect shifts in consumer spending patterns, impacting various industries.

IV. Managing Discretionary Income

1. Budgeting:

Create a budget to allocate income effectively. This involves setting aside funds for savings, entertainment, and other non-essential expenses.

2. Emergency Fund:

Prioritize building an emergency fund from income to cover unexpected expenses and provide financial security.

3. Investing:

Consider investment opportunities to grow wealth over time. Income can be allocated to various investment vehicles such as stocks, bonds, or retirement accounts.

V. Challenges and Considerations

1. Fluctuations in Income:

Is sensitive to fluctuations in income. Job loss or reduction in income can significantly impact the amount available for discretionary spending.

2. Changing Priorities:

Individual priorities may shift over time, affecting how discretionary income is allocated. Flexibility in budgeting is crucial to adapt to evolving circumstances.

VI. Economic Impact of Discretionary Income

1. Consumer Spending:

Consumer spending, largely influenced by discretionary income, plays a vital role in driving economic growth. Increased spending can stimulate various sectors of the economy.

2. Business Strategies:

Businesses often tailor their marketing and product strategies based on an understanding of consumer discretionary income trends.

Elevating Security Awareness: A Comprehensive Guide

Mastering Collaboration: Work Together Best Results

VII. Conclusion

In conclusion, discretionary income is a pivotal factor in shaping individual financial choices and influencing economic trends.

Understanding how to calculate, manage, and leverage discretionary can empower individuals to navigate their financial journeys with confidence.