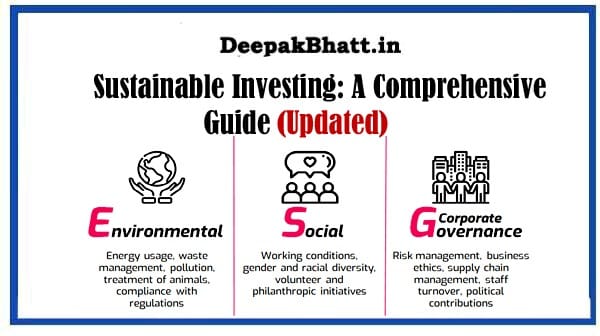

Sustainable Investing In the contemporary financial landscape, sustainable investing has emerged as a transformative

Approach that aligns financial goals with environmental, social, and governance (ESG) considerations.

This comprehensive guide aims to provide a deep understanding of sustainable investing, its principles, strategies, and its pivotal role in shaping the future of finance.

Quantitative Analysis: A Comprehensive Guide

Ponzi Scheme: A Comprehensive Guide

Elevating Security Awareness: A Comprehensive Guide

Mastering Collaboration: Work Together Best Results

Defining Sustainable Investing

1. Definition:

Sustainable investing, also known as socially responsible investing (SRI) or ESG investing, is an investment strategy that seeks to generate positive financial returns while promoting sustainable and ethical practices. It involves considering environmental, social, and governance factors alongside traditional financial metrics.

2. Key Characteristics:

Sustainable investing integrates ESG criteria into the investment decision-making process. Investors actively seek companies and projects that contribute to sustainable practices and positive societal impact.

Principles of Sustainable Investing

1. Environmental Considerations:

This involves evaluating a company’s impact on the environment, including its carbon footprint, resource usage, and commitment to sustainable practices such as renewable energy.

2. Social Impact:

Social considerations assess a company’s treatment of its employees, community engagement, diversity and inclusion policies, and overall impact on society.

3. Governance Practices:

Governance factors focus on a company’s leadership, transparency, ethical decision-making, and adherence to principles that promote responsible business conduct.

Strategies in Sustainable Investing

1. Negative Screening:

This strategy involves excluding certain industries or companies that do not align with ESG principles, such as tobacco, weapons, or fossil fuels.

2. Positive Screening:

Positive screening involves actively selecting investments that meet specific ESG criteria, supporting companies with exemplary sustainable practices.

3. Impact Investing:

Impact investing targets investments that aim to generate measurable, positive social and environmental impact alongside financial returns. This can include investments in renewable energy, affordable housing, or healthcare.

4. Integration of ESG Factors:

Integrating ESG factors into traditional financial analysis is a holistic approach where investors consider sustainability alongside traditional financial metrics in their decision-making process.

Measuring and Reporting ESG Performance

1. ESG Ratings:

ESG rating agencies assess companies based on their environmental, social, and governance performance. Investors use these ratings to inform their investment decisions.

2. Sustainability Reports:

Many companies produce sustainability reports that provide detailed information on their ESG practices, helping investors gauge their commitment to sustainable business operations.

Challenges and Considerations in Sustainable Investing

1. Data Quality and Standardization:

Challenges exist in obtaining consistent and reliable ESG data. Efforts are underway to standardize reporting and enhance data quality across the industry.

2. Balancing Returns and Impact:

Sustainable investors aim to strike a balance between financial returns and positive impact. Achieving both requires careful consideration of investment choices.

The Rise of Green Bonds and Sustainable Funds

1. Green Bonds:

Green bonds are financial instruments specifically earmarked for environmentally friendly projects. Investors purchase these bonds with the assurance that their funds will contribute to sustainable initiatives.

2. Sustainable Funds:

The proliferation of sustainable or ESG funds allows investors to allocate their capital to a diversified portfolio of companies adhering to sustainable practices.

The Business Case for Sustainable Investing

1. Risk Mitigation:

Companies with strong ESG practices are often better positioned to manage risks related to environmental and social issues, fostering long-term resilience.

2. Innovation and Efficiency:

Sustainable practices drive innovation and efficiency, leading to cost savings and enhanced competitiveness for companies in the long run.

Conclusion

In conclusion, sustainable investing represents a paradigm shift in the financial industry, aligning capital with positive societal and environmental outcomes.

Whether through ESG integration, impact investing, or supporting sustainable funds, investors play a crucial role in shaping a future where financial success is synonymous with environmental and social responsibility.

Welcome all of you to my website. I keep updating posts related to blogging, online earning and other categories. Here you will get to read very good posts. From where you can increase a lot of knowledge. You can connect with us through our website and social media. Thank you