What is Divident: A term often whispered in financial conversations, represent a tangible return on investment for shareholders.

Whether you’re a seasoned investor or just starting to dip your toes into the stock market, understanding dividends is crucial for making informed investment decisions.

In this comprehensive guide, we’ll unravel the complexities of dividends, exploring their definition, types, significance, and the strategies investors employ to optimize returns.

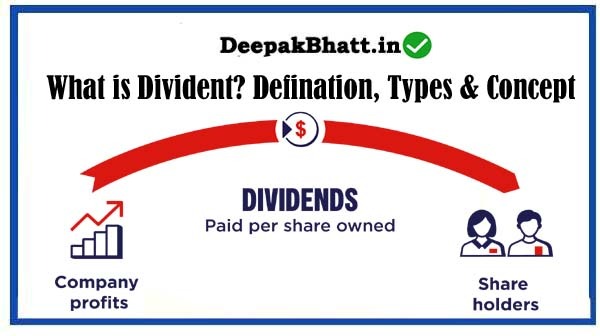

What is Divident?

At its core, a dividend is a payment made by a corporation to its shareholders, typically in the form of cash or additional shares of stock.

It’s a tangible way for companies to share their profits with investors who hold a stake in the company.

Dividends serve as a reward for investing in a particular stock, providing a steady income stream for shareholders.

Types of Dividends

1. Cash Dividends

Cash dividends are the most common type of dividend payment. Shareholders receive a cash distribution directly into their brokerage accounts.

Investors often view cash dividends as a source of regular income, especially in retirement portfolios.

2. Stock Dividends

In a stock dividend, shareholders receive additional shares of the company’s stock instead of cash.

While the overall value of the investment remains the same, stock dividends can be advantageous for investors looking to increase their position in a particular stock.

3. Property Dividends

Less common but still existing, property dividends involve distributing physical assets or products instead of cash or stock.

This type of dividend is more prevalent in specific industries where companies may have excess inventory or assets.

4. Special Dividends

Special dividends are one-time, non-recurring payments that companies issue to shareholders.

These dividends are often declared when a company experiences an unusually profitable period or has substantial cash reserves.

Significance of Dividends

1. Steady Income Stream

For income-focused investors, dividends provide a reliable and often predictable stream of income.

This income can be especially valuable during economic downturns when the value of stocks may be more volatile.

2. Signal of Financial Health

Companies that consistently pay dividends are generally viewed as financially stable and mature.

A history of regular dividend payments can be a positive indicator of a company’s financial health and management’s confidence in future earnings.

3. Total Return on Investment

Total return on investment encompasses both capital appreciation (increase in the stock’s price) and dividend income.

Dividends contribute significantly to the total return, making them a crucial component for long-term investors.

Strategies for Dividend Investing

1. Dividend Yield

Dividend yield is a key metric for dividend investors, calculated by dividing the annual dividend payment by the stock’s current market price. A higher dividend yield indicates a potentially more attractive income opportunity.

2. Dividend Growth Investing

Some investors focus on companies with a history of consistently increasing their dividends.

These companies are often well-established and have a track record of financial stability and growth.

3. Dividend Reinvestment Plans (DRIPs)

DRIPs allow investors to reinvest their dividend earnings back into the same stock, purchasing additional shares.

This strategy harnesses the power of compounding, enabling the investor to accumulate more shares over time.

Tax Implications of Dividends

While dividends can be a valuable income stream, they are not tax-free.

The tax treatment of dividends depends on various factors, including the type of dividend, the investor’s tax bracket, and the holding period of the investment.

It’s crucial for investors to understand the tax implications to make informed decisions about their portfolios.

Risks and Considerations

1. Dividend Cuts

Companies may reduce or eliminate dividends during challenging economic times. Investors should be aware of the financial health of the companies in which they invest to anticipate potential dividend cuts.

2. Interest Rate Sensitivity

Dividend stocks can be sensitive to changes in interest rates. When interest rates rise, income-focused investors may shift their preferences to fixed-income securities, impacting the demand for dividend-paying stocks.

3. Market Volatility

Like any investment, the value of dividend-paying stocks can fluctuate. Investors should be prepared for market volatility and have a long-term perspective when engaging in dividend investing.

Basics of Personal Finance: Getting Started

Learn Basics of Finance Tutorials

What is Personal Finance? Do you know Let’s Start

Frequently Asked Questions (FAQs)

Q1: How often are dividends paid?

A: Dividends can be paid on various schedules, including quarterly, semi-annually, or annually. The frequency depends on the company’s policies and financial performance.

Q2: Can dividends be reinvested automatically?

A: Yes, through Dividend Reinvestment Plans (DRIPs), investors can opt to automatically reinvest their dividend earnings back into the same stock, acquiring additional shares.

Q3: Do all companies pay dividends?

A: No, not all companies pay dividends. Some prefer to reinvest profits into the business for growth, while others choose to distribute profits to shareholders.

Conclusion

In conclusion, dividends are a powerful financial tool that goes beyond the realm of stock market jargon.

They represent a tangible return on investment, providing investors with income, a signal of financial health, and a crucial component of total return.

Whether you’re a seasoned investor or a novice, understanding dividends opens the door to a world of financial opportunities and strategic investment decisions.

Welcome all of you to my website. I keep updating posts related to blogging, online earning and other categories. Here you will get to read very good posts. From where you can increase a lot of knowledge. You can connect with us through our website and social media. Thank you