Capital Asset Pricing Model In the dynamic world of finance, the Capital Asset Pricing Model (CAPM)

Capital Asset Pricing Model (CAPM)

Stands as a foundational framework, providing insights into the relationship between risk and return.

Venture Capital: Free Process, Types & Impact

Options Trading: Concept Key, Types & Applications

How to become a web designer Free Tips

Whether you’re an aspiring investor, financial analyst, or simply curious about the intricacies of financial models, understanding CAPM is a valuable asset.

This blog post will delve into the depths of CAPM, demystifying its components and showcasing its significance in the world of investment.

Mastering React In 2024: The Comprehensive Free Guide

Cyber Security Course : Hackers Exposed! 87%

I. Introduction to CAPM

1. The Essence of CAPM:

At its core, CAPM is a financial model that seeks to quantify the expected return on an investment based on its risk.

Developed by William Sharpe, John Lintner, and Jan Mossin in the 1960s, CAPM has become a cornerstone for evaluating the expected return of an investment relative to its risk.

2. The Risk-Return Tradeoff:

CAPM operates on the principle of the risk-return tradeoff, asserting that investors should be compensated for taking on additional risk.

The model helps determine the appropriate expected return for an investment given its risk profile.

II. The Components of Capital Asset Pricing Model

1. Risk-Free Rate (Rf):

At the heart of CAPM is the risk-free rate, representing the return an investor would expect from a completely risk-free investment. Typically, the yield on government bonds, such as U.S. Treasury bonds, serves as the proxy for the risk-free rate.

2. Market Risk Premium (Rm – Rf):

The market risk premium is the excess return expected from the overall market beyond the risk-free rate. It captures the additional compensation investors seek for taking on the inherent risk of the market. Calculated as the difference between the expected market return and the risk-free rate, it quantifies the premium investors demand for market risk.

3. Beta (β):

Beta is a measure of an asset’s sensitivity to market movements. It gauges how much an asset’s price is likely to move concerning changes in the broader market. A beta of 1 indicates that the asset is expected to move in line with the market, while a beta greater than 1 suggests higher volatility, and a beta less than 1 implies lower volatility.

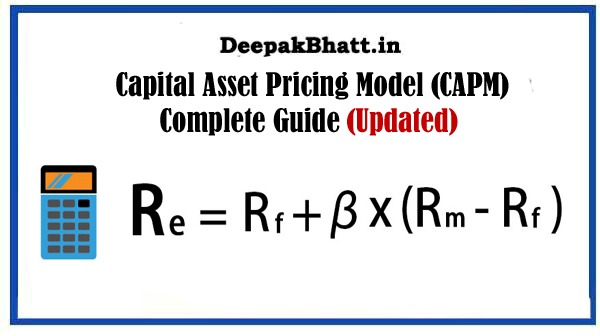

4. The CAPM Formula:

The CAPM formula succinctly expresses the relationship between these components:

Expected Return=Risk-Free Rate+(Beta×Market Risk Premium)Expected Return=Risk-Free Rate+(Beta×Market Risk Premium)

This formula provides a clear and quantifiable method for estimating the expected return on an investment based on its risk exposure.

III. Practical Applications of Capital Asset Pricing Model

1. Investment Decision-Making:

Investors and financial analysts employ CAPM to make informed investment decisions. By assessing the expected return of an investment relative to its risk, individuals can compare different investment opportunities and make choices aligned with their risk tolerance and financial goals.

2. Cost of Capital:

CAPM is instrumental in determining the cost of capital for companies. By evaluating the expected return on equity, businesses can assess the minimum return required by investors to justify the risk associated with holding their stock.

3. Portfolio Management:

CAPM plays a crucial role in portfolio management. Investors can use the model to construct well-diversified portfolios that optimize risk and return, balancing assets with different beta values to achieve desired risk exposure.

IV. Criticisms and Limitations of CAPM

1. Assumptions:

CAPM is built upon several assumptions, including the efficiency of markets, a linear relationship between risk and return, and constant betas over time. Critics argue that these assumptions might not always hold true in real-world financial markets.

2. Simplistic Nature:

Some critics assert that CAPM oversimplifies the complexities of financial markets. The model’s reliance on historical data and beta as the sole measure of risk has been challenged, with some arguing for the inclusion of additional risk factors.

V. The Evolving Landscape: Extensions and Alternatives

1. Fama-French Three-Factor Model:

Building on CAPM, the Fama-French Three-Factor Model introduces additional factors—market risk, size, and value—that aim to provide a more comprehensive explanation of asset returns. This model challenges the simplicity of CAPM and incorporates multifactor analysis.

2. Modern Portfolio Theory (MPT):

Developed by Harry Markowitz, MPT considers not only the risk and return of individual assets but also their correlation with each other. By diversifying across assets with low correlation, investors can achieve a more efficient portfolio.

3. CAPM in the Digital Age:

With advancements in technology and access to vast amounts of financial data, there is ongoing research and development in refining models like CAPM. Machine learning and data analytics are being leveraged to enhance risk assessment and return predictions.

VI. Conclusion: Navigating the Financial Seas with CAPM

In conclusion, CAPM remains a foundational tool in the realm of finance, offering a structured approach to assessing the risk and return of investments. As with any model, it’s essential to understand its assumptions, limitations, and the evolving landscape of financial research.

Welcome all of you to my website. I keep updating posts related to blogging, online earning and other categories. Here you will get to read very good posts. From where you can increase a lot of knowledge. You can connect with us through our website and social media. Thank you