Earnings Per Share (EPS) is a fundamental financial metric that plays a crucial role in assessing a company’s profitability and overall financial health.

It serves as an indicator of the company’s ability to generate earnings for its shareholders.

Understanding EPS is essential for investors, analysts, and financial professionals as it provides insights into a company’s performance and aids in making informed investment decisions.

Fundamental Analysis: Foundation of Investment Guide

Custodian Definition & Meaning, Types

Technical Analysis: Complete Guide Trading

- 1 Earnings Per Share

- 1.1 Calculation of EPS:

- 1.2 Net Income:

- 1.3 Weighted Average Number of Outstanding Shares:

- 1.4 Types of EPS:

- 1.5 Interpreting EPS:

- 1.6 Limitations of EPS:

- 1.7 Additional Considerations:

- 1.8 Importance of EPS in Investment Decision-Making:

- 1.9 Challenges in Interpreting EPS:

- 1.10 Case Studies and Examples:

- 1.11 Conclusion:

Blockchain And Bitcoin Fundamentals Video Course

Beginner To Pro In Excel: Mastering Financial

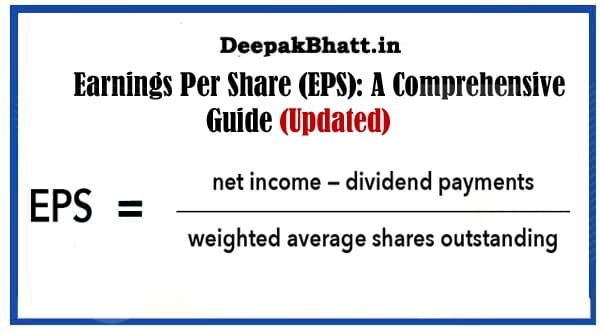

Calculation of EPS:

The formula for calculating Earnings Per Share is relatively straightforward:

EPS=Net Income/Weighted Average Number of Outstanding Shares

EPS=Weighted Average Number of Outstanding SharesNet Income

Net Income:

Net income represents the total earnings or profit generated by the company after deducting all operating expenses, taxes, and interest. It is a key figure in the income statement.

The weighted average number of outstanding shares considers changes in the number of shares over a specific period, giving more weight to periods with more outstanding shares. Earnings Per Share This helps in providing a more accurate representation of the company’s financial performance.

Types of EPS:

Understanding the different types of EPS is crucial for a comprehensive analysis:

Basic EPS:

Basic EPS uses the actual number of outstanding shares for the calculation. It is a straightforward measure of a company’s earnings per share.

Diluted EPS:

Diluted EPS takes into account the potential dilution from convertible securities, such as stock options and convertible bonds. It assumes the conversion of these securities into common stock, providing a more conservative measure of EPS.

Interpreting EPS:

Interpreting the EPS involves considering various factors and making comparisons to gain meaningful insights:

Positive EPS:

A positive EPS indicates that the company is profitable. Investors generally view a higher EPS as a positive sign of a company’s financial strength.

Negative EPS:

A negative EPS suggests that the company incurred a net loss during the period. This could be a red flag for investors, indicating financial challenges.

Comparing EPS:

Comparing a company’s current EPS with its historical EPS allows for an assessment of its growth or decline in profitability over time.

Industry Comparison:

Comparing a company’s EPS with industry peers provides context for its performance within the sector. This benchmarking is essential to understand a company’s standing in the competitive landscape.

Market Expectations:

Analysts often provide EPS estimates. If a company exceeds these estimates, it may experience a positive impact on its stock price, as it indicates outperformance.

Trend Analysis:

Tracking the trend of EPS over several quarters or years helps identify patterns and assess the company’s consistency in delivering profits.

Limitations of EPS:

While EPS is a valuable metric, it does have limitations that should be considered:

Ignoring Quality of Earnings:

EPS may not provide a complete picture of a company’s financial health. It’s crucial to consider the quality of earnings, which involves assessing the sustainability and reliability of the reported profits.

Not Accounting for Non-Cash Items:

EPS may not fully reflect the impact of non-cash items, such as depreciation and amortization. Therefore, it is essential to complement EPS analysis with a thorough examination of the entire income statement.

Manipulation:

Companies may engage in earnings management practices, manipulating earnings to present a more favorable picture. This can impact the accuracy of EPS as a measure of profitability.

Additional Considerations:

Exploring further aspects related to EPS enhances the understanding of its implications:

Preferred Dividends:

When calculating EPS for common shareholders, it’s crucial to subtract preferred dividends from net income. This adjustment ensures that the metric specifically represents the earnings available to common shareholders.

Stock Buybacks:

Companies often engage in stock buybacks, repurchasing their own shares. While this can boost EPS by reducing the number of outstanding shares, investors should carefully analyze the motivations behind such actions and their long-term impact.

Use in Valuation:

Investors commonly use EPS as a component in valuation ratios, such as the price-to-earnings (P/E) ratio. The P/E ratio provides insights into how the market values a company’s earnings.

Forward EPS:

Analysts often provide estimates for future EPS, known as forward EPS. This forward-looking metric is valuable for investors making decisions based on expected future earnings rather than historical performance.

Importance of EPS in Investment Decision-Making:

Understanding EPS is crucial for making informed investment decisions. Here’s why:

Profitability Indicator:

EPS is a direct measure of a company’s profitability. Investors seek companies with a consistent and positive EPS as it reflects the ability to generate earnings.

Comparison Tool:

Investors use EPS to compare the financial performance of different companies within an industry. This comparative analysis helps in identifying strong contenders for investment.

Investor Expectations:

Companies exceeding analyst expectations for EPS may experience positive stock price movements. Investors often use EPS estimates as a benchmark for evaluating a company’s performance against market expectations.

Long-Term Growth Assessment:

By analyzing the trend of EPS over several periods, investors can assess a company’s long-term growth potential. Consistent growth in EPS may indicate a financially sound and well-managed company.

Challenges in Interpreting EPS:

Investors should be aware of certain challenges associated with interpreting EPS:

One Metric Among Many:

While EPS is an important metric, it should not be the sole basis for investment decisions. It is crucial to consider a comprehensive set of financial ratios and indicators for a thorough analysis.

Accounting Changes:

Changes in accounting standards can impact the calculation of EPS. Investors should stay informed about accounting updates to accurately interpret EPS figures.

Case Studies and Examples:

To illustrate the practical application of EPS analysis, consider examining case studies and real-world examples. Analyzing how companies with varying EPS perform in different market conditions provides valuable insights.

Conclusion:

In conclusion, Earnings Per Share is a powerful tool for investors, providing a snapshot of a company’s profitability and performance.

However, it is essential to interpret EPS in conjunction with other financial metrics, considering the specific industry context and the company’s overall financial health.

By understanding the nuances of EPS calculation, types, interpretation, limitations, and its role in investment decision-making, investors can make more informed and strategic choices in the dynamic world of financial markets.