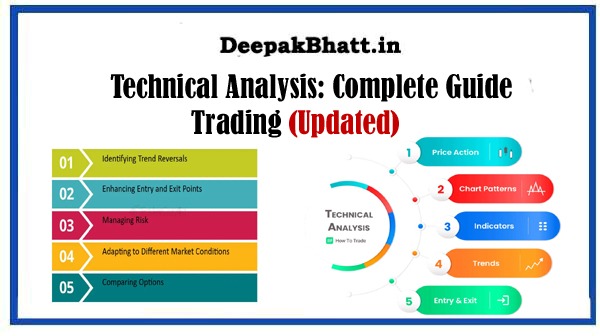

Technical Analysis In the dynamic and fast-paced realm of financial markets

Stands as a key methodology for traders seeking to make well-informed decisions.

This comprehensive guide aims to provide a deep understanding of technical analysis, its principles, tools, and its crucial role in deciphering market trends.

IOS App Development: A Comprehensive Guide

Presentation And Public Speaking 87% Free Course

Sustainable Investing: A Comprehensive Guide

Quantitative Analysis: A Comprehensive Guide

I. Defining

1. Definition:

Technical analysis is a method of evaluating and forecasting financial markets by analyzing historical price and volume data. It relies on the premise that historical price movements and trading volumes can provide insights into future market trends.

2. Key Characteristics:

Technical analysts use charts, patterns, and various technical indicators to identify potential entry and exit points for trades. The focus is on price action and market sentiment.

II. Key Principles

1. Price Discounts Everything:

Technical analysts believe that all information, whether public or private, is already reflected in the price of an asset. Therefore, they focus on price movements to make trading decisions.

2. Price Moves in Trends:

It is based on the idea that prices tend to move in trends, whether upward, downward, or sideways. Identifying and following these trends is central to technical analysis.

3. History Tends to Repeat Itself:

Technical analysts operate on the assumption that historical price patterns and trends are likely to repeat in the future. Chart patterns are often used to predict potential market movements.

III. Tools and Techniques

1. Charts:

Charts, such as candlestick charts and line charts, are fundamental to technical analysis. They visually represent price movements over a specified time period.

2. Technical Indicators:

Indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) help traders assess market momentum, trend strength, and potential reversal points.

3. Support and Resistance:

Support and resistance levels are key concepts in technical analysis. Support is a price level at which a security often stops falling, while resistance is a level at which it stops rising.

4. Trendlines:

Trendlines are drawn on charts to represent the direction and strength of a trend. They help identify potential trend reversal or continuation points.

Types of Charts

1. Line Charts:

Line charts connect closing prices over a specified time period, providing a simple visualization of price trends.

2. Bar Charts:

Bar charts display opening, closing, high, and low prices for a specific time interval, offering more detailed information than line charts.

3. Candlestick Charts:

Candlestick charts provide a visual representation of price movements, showing the open, close, high, and low prices in a candlestick format.

Chart Patterns in Technical Analysis

1. Head and Shoulders:

This reversal pattern indicates a potential trend change and consists of three peaks: a higher peak (head) between two lower peaks (shoulders).

2. Double Tops and Bottoms:

Double tops signal a potential reversal in an uptrend, while double bottoms suggest a reversal in a downtrend.

3. Triangles:

Symmetrical triangles, ascending triangles, and descending triangles are chart patterns that help traders identify potential breakout or breakdown points.

Applications of Technical Analysis

1. Day Trading:

Technical analysis is widely used in day trading, where traders make short-term trades based on intraday price movements.

2. Swing Trading:

Swing traders use technical analysis to identify trends and potential reversal points for trades held over a few days to weeks.

3. Long-Term Investing:

Even long-term investors may use technical analysis to identify favorable entry points for building or adjusting their investment portfolios.

Challenges and Criticisms of Technical Analysis

1. Subjectivity:

Critics argue that technical analysis can be subjective, as analysts may interpret charts differently.

2. Market Efficiency:

The Efficient Market Hypothesis suggests that all available information is already reflected in prices, making it challenging to gain a consistent edge through technical analysis.

Conclusion:

In conclusion, technical analysis is a powerful tool for traders and investors seeking to navigate the complexities of financial markets. By interpreting price charts, identifying trends, and using technical indicators, practitioners of technical analysis gain insights to make informed trading decisions.

So, whether you’re a day trader, swing trader, or long-term investor, understanding the principles and tools of technical analysis equips you with the expertise to navigate the ever-evolving landscape of financial markets. Happy trading!

Welcome all of you to my website. I keep updating posts related to blogging, online earning and other categories. Here you will get to read very good posts. From where you can increase a lot of knowledge. You can connect with us through our website and social media. Thank you