Market capitalization weighted In the vast expanse of financial markets

where indices serve as benchmarks for performance and guides for investment strategies, market capitalization-weighted indexing stands as a prominent methodology.

This approach, often referred to as cap-weighted or cap-value weighting, involves constructing an index in which the individual components are weighted based on their market capitalization.

This comprehensive guide aims to unravel the intricacies of market capitalization-weighted indexing, shedding light on its principles, advantages, challenges, and the broader implications for investors navigating the ever-evolving landscape of financial instruments.

What is Equity? Concept, Types & Future Free Trends

What is IPO? Concept, Process & Significance Free

Mezzanine Financing : Types & Characteristics

Unraveling the Essence of Market Capitalization Weighted Indexing

Market capitalization-weighted indexing is a methodology that assigns a higher weight to companies with larger market capitalizations.

Market capitalization, or market cap, is calculated by multiplying the current market price of a company’s shares by the total number of outstanding shares.

In a market cap-weighted index, the influence of each constituent on the index’s performance is proportional to its market cap.

Key Components of Market Capitalization Weighted Indexing:

Market Capitalization: The total value of a company’s outstanding shares, calculated by multiplying the share price by the number of shares outstanding.

Weighting Scheme: Companies with larger market capitalizations are assigned higher weights in the index, influencing the overall performance of the index to a greater extent.

Principles of Market Capitalization Weighted Indexing

Understanding the principles that underlie market capitalization-weighted indexing is crucial for investors and market participants. Here are the key principles that govern this methodology: Market capitalization weighted

Free Course:

Mezzanine Financing : Types & Characteristics

Mobile App Marketing: Monetization 85% Free Course

Ultimate MySQL Bootcamp Free Course With 85 %

1. Reflecting Market Dynamics:

Market capitalization weighting aims to reflect the market’s assessment of the value of a company. Companies with higher market caps are considered by the market to have a higher value.

2. Passive Investment Approach:

Market capitalization-weighted indexes are often associated with passive investment strategies. Passive investors seek to replicate the performance of the index by holding securities in proportions that mirror the index’s composition.

3. Self-Adjusting Nature:

The market cap-weighted approach is self-adjusting. As the market values of individual companies change, the composition of the index naturally adjusts to reflect these changes.

4. Broad Market Representation:

Market cap-weighted indexes typically provide broad market representation. Larger companies, often considered leaders in their respective industries, exert a significant influence on the index’s performance.

Advantages of Market Capitalization Weighted Indexing

Market capitalization-weighted indexing comes with several advantages that have contributed to its widespread adoption among investors and fund managers. Here are key benefits associated with this indexing methodology:

1. Reflecting Market Sentiment:

By assigning higher weights to companies with larger market caps, the index captures the market’s sentiment and collective assessment of a company’s value.

2. Low Turnover:

Market cap-weighted indexes tend to have lower turnover compared to alternative weighting schemes. This can result in lower transaction costs for investors and reduced tax implications.

3. Simplicity:

The simplicity of market capitalization-weighted indexing is a significant advantage. The methodology is straightforward, making it easy for investors to understand and implement in their investment strategies.

4. Broad Market Exposure:

Investors utilizing market cap-weighted indexes gain exposure to a broad representation of the market. This diversification helps spread risk across various sectors and industries.

5. Stability and Resilience:

Market cap-weighted indexes demonstrate stability and resilience over time. The inclusion of well-established companies with proven track records contributes to the overall stability of these indexes.

Challenges and Criticisms

While market capitalization-weighted indexing has proven to be a popular and effective strategy, it is not without its challenges and criticisms. Here are some considerations that investors should be aware of:

1. Concentration in Largest Companies:

The methodology inherently leads to a concentration of the index in the largest companies. Critics argue that this concentration may lead to overvaluation of certain stocks and increased risk in the portfolio.

2. Momentum Effect:

Market cap-weighted indexes may exhibit a momentum effect, where stocks that have experienced significant price increases attract more capital, leading to further price increases. This can contribute to market bubbles and increased volatility.

3. Lack of Consideration for Fundamentals:

The market cap-weighted approach does not take into account fundamental metrics such as earnings, dividends, or financial health. Critics argue that this oversight can result in overvalued companies being overweighted in the index.

4. Vulnerability to Market Swings:

During market downturns, market cap-weighted indexes may be more vulnerable to severe declines due to the higher weightings of larger companies. This can impact the overall performance of the index.

5. Potential for Herding Behavior:

Market cap-weighted indexes may encourage herding behavior among investors, as they allocate more capital to stocks that have performed well recently. This can lead to inflated valuations and increased market fragility.

Alternatives and Modified Approaches

Recognizing the challenges associated with market capitalization-weighted indexing, investors and fund managers have explored alternative and modified approaches to achieve specific objectives. Some of these approaches include:

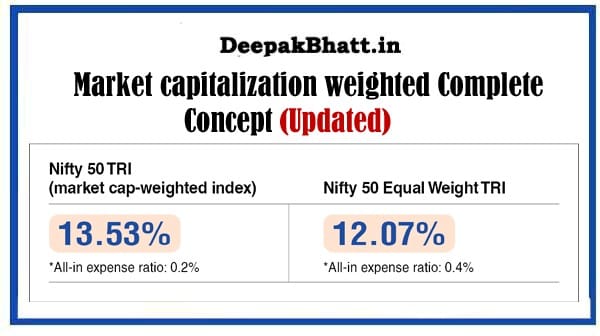

1. Equal Weighting:

Equal weighting assigns the same weight to each constituent in the index, regardless of market capitalization. This approach aims to reduce concentration risk and provides more balanced exposure to smaller companies.

2. Fundamental Weighting:

Fundamental weighting considers financial metrics such as earnings, dividends, and book value to determine the weightings of individual securities. This approach aims to avoid overvalued stocks and provides exposure to companies with strong fundamentals.

3. Minimum Variance Indexing:

Minimum variance indexing seeks to construct an index with the lowest possible volatility. The methodology considers the historical volatility of individual securities and aims to create a portfolio with minimized overall risk.

4. Smart Beta Strategies:

Smart beta strategies combine elements of both passive and active management. These strategies may use factors such as value, momentum, or low volatility to determine the weightings of individual securities.

5. Factor-Based Indexing:

- Factor-based indexing involves constructing an index based on specific factors, such as growth, value, or size. These factors are used to determine the weightings of individual securities in the index.

Future Trends in Indexing Methodologies

As financial markets evolve and investors seek more sophisticated strategies, several trends are shaping the future of indexing methodologies:

1. ESG Integration:

Environmental, Social, and Governance (ESG) factors are increasingly being integrated into indexing methodologies. ESG-focused indexes aim to align investments with sustainable and responsible practices.

2. Customization and Personalization:

Investors are expressing a growing interest in customized and personalized indexing solutions. This trend may lead to the development of more tailored indexes that align with specific investment objectives.

3. Advances in Technology:

Technological advancements, including artificial intelligence and machine learning, may influence the development of more dynamic and adaptive indexing methodologies. These technologies can enhance the efficiency and responsiveness of index construction.

4. Increased Focus on Risk Management:

The importance of risk management is likely to influence the development of indexing methodologies. Investors may seek indexes that not only provide market exposure but also incorporate risk management features.

Conclusion

In conclusion, market capitalization-weighted indexing stands as a foundational and widely adopted methodology in the world of finance. Its simplicity, broad market representation, and stability have contributed to its popularity among investors and fund managers.

Welcome all of you to my website. I keep updating posts related to blogging, online earning and other categories. Here you will get to read very good posts. From where you can increase a lot of knowledge. You can connect with us through our website and social media. Thank you