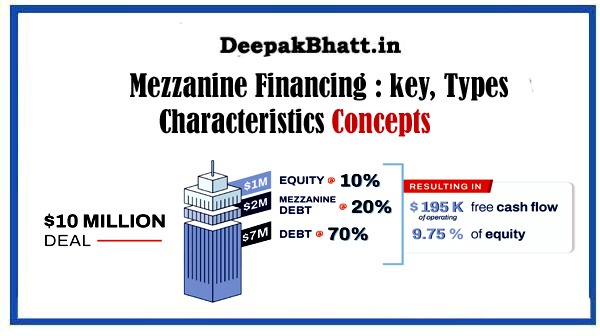

Mezzanine Financing In the intricate landscape of corporate finance. where businesses seek optimal capital structures.

To fuel growth and expansion, mezzanine financing emerges as a versatile and strategic tool.

Represents a hybrid form of capital that combines elements of debt and equity, offering companies a flexible means to secure funding.

This comprehensive guide aims to demystify the concept of mezzanine financing, delving into its characteristics, structures, applications, and the broader implications for businesses navigating the complex terrain of capital raising.

Online Course:

Ultimate MySQL Bootcamp Free Course With 85 %

Python For Absolute Beginners With 85% Discount

Hacking For Beginners Free Course With 85% Discount

Unraveling the Essence of Mezzanine Financing

Occupies a unique space in the capital structure, positioned between traditional debt and equity.

It typically takes the form of subordinated debt or preferred equity, offering a middle ground that provides companies with access to capital while accommodating the risk-return preferences of both lenders and equity investors.

Cash Flow Statement? Free Featurs & Types

What is Bull Market? Characteristics, Strategies

What is Bear Market? Features, Strategies

What is Liquidity? Features, Metrics & Impact

Key Components :

- Subordinated Debt: Mezzanine financing often involves the issuance of subordinated debt, which ranks below senior debt in terms of repayment priority.

- Equity Conversion Feature: Mezzanine instruments may come with an equity conversion feature, allowing the lender to convert their debt into equity under certain conditions.

- Higher Risk, Higher Return: Mezzanine financing carries higher risk compared to senior debt, and in return, investors typically expect higher returns.

Types

Encompasses various structures tailored to meet the specific needs of businesses. Here are the common types of mezzanine financing:

1. Subordinated Debt:

Characteristics: This involves the issuance of debt with a lower priority of repayment compared to senior debt. It may have features such as payment-in-kind (PIK) interest, allowing interest to be paid through additional debt rather than cash.

2. Convertible Debt:

Equity Conversion: Mezzanine financing can take the form of convertible debt, allowing the lender to convert their debt into equity if certain conditions, such as a specified time period or financial milestone, are met.

3. Preferred Equity:

Equity Investment: Mezzanine financing may involve an equity investment with characteristics of preferred equity. Investors receive preferential treatment in terms of dividends and liquidation preferences.

4. Mezzanine Loans:

Hybrid Structure: Mezzanine loans combine debt and equity features. They may include options for equity participation, warrants, or other features that enhance the overall return for investors.

5. Equity Kicker:

Additional Return: An equity kicker is an additional return mechanism for mezzanine financing. It may involve receiving warrants, options, or a share of equity in the company.

Characteristics

Understanding the key characteristics of mezzanine financing is crucial for companies considering this form of capital. Here are the defining features:

1. Higher Risk Tolerance:

Mezzanine investors typically have a higher risk tolerance compared to traditional lenders. They are willing to take on additional risk in exchange for the potential for higher returns.

2. Flexible Repayment Terms:

Offers more flexibility in repayment terms compared to traditional debt. It may include features such as payment-in-kind (PIK) interest or flexible amortization schedules.

3. Subordinated Position:

Mezzanine debt is subordinated to senior debt in the capital structure, meaning it has a lower priority of repayment. This subordination reflects the higher risk associated with mezzanine financing.

4. Equity Participation:

Often includes an equity participation feature, allowing investors to share in the upside of the company’s success through equity conversion or other mechanisms.

5. Tailored Structures:

Structures can be tailored to meet the specific needs of the company and its growth plans. This flexibility makes it an attractive option for businesses with unique financing requirements.

Applications

Serves a variety of purposes for businesses seeking capital infusion. Here are common applications:

1. Funding Growth Initiatives:

Companies use mezzanine financing to fund expansion, whether through geographic expansion, new product development, or entry into new markets.

2. Acquisition Financing:

Is often employed to fund mergers and acquisitions. It provides a source of capital to support the acquisition of other businesses.

3. Recapitalization:

Can be used in recapitalization efforts, allowing businesses to optimize their capital structure and address existing debt obligations.

4. Management Buyouts:

In management buyout situations, where the existing management team acquires the business, mezzanine financing can be a key component of the funding structure.

5. Shareholder Liquidity:

Allows existing shareholders to achieve liquidity without selling a significant portion of their equity. This is particularly relevant in situations where founders or early investors seek to monetize part of their investment.

Benefits

Mezzanine financing offers several benefits that make it an attractive option for businesses and investors alike:

1. Access to Capital:

Provides companies with access to a significant amount of capital, allowing them to pursue growth opportunities that may not be feasible with traditional debt alone.

2. Flexibility:

The flexible nature of mezzanine financing allows for customized structures that align with the specific needs and growth plans of the company.

3. Limited Dilution:

Compared to equity financing, mezzanine financing often involves limited dilution for existing shareholders, making it an attractive option for founders and early investors.

4. Equity Upside:

Mezzanine investors have the potential to participate in the equity upside of the company’s success. This aligns their interests with the long-term success of the business.

5. Diverse Applications:

Mezzanine financing can be applied in various scenarios, from funding acquisitions to supporting organic growth initiatives, making it a versatile tool in the corporate finance toolkit.

Risks and Challenges

While mezzanine financing offers significant advantages, it comes with inherent risks and challenges that companies and investors must navigate:

1. Higher Cost of Capital:

Mezzanine financing typically carries a higher cost of capital compared to traditional debt. Companies must assess whether the benefits justify the higher financing costs.

2. Risk of Default:

Due to the subordinated nature of mezzanine debt, there is an increased risk of default in the event of financial distress. Companies must carefully manage their financial performance to meet repayment obligations.

3. Equity Dilution:

While mezzanine financing involves limited dilution compared to equity financing, there is still a potential for equity dilution if conversion or equity participation features are triggered.

4. Market Conditions:

Mezzanine financing may be influenced by market conditions, and companies should carefully consider the timing of such financing to optimize terms and costs.

5. Complex Structures:

The complexity of mezzanine financing structures requires careful consideration and understanding by all parties involved. Legal and financial complexities should be thoroughly evaluated.

Future Trends in Mezzanine Financing

As financial markets evolve and businesses seek innovative financing solutions, several trends are shaping the future of mezzanine financing:

1. Increased Demand in Growing Sectors:

Growing sectors such as technology and healthcare may see increased demand for mezzanine financing as companies in these industries pursue expansion and innovation.

2. Sustainable Finance:

Mezzanine financing may play a role in sustainable finance, supporting companies with environmentally and socially responsible initiatives.

3. Technology Integration:

The integration of technology in mezzanine financing processes, including digital platforms for due diligence and documentation, may streamline and enhance efficiency.

4. Growth of Private Credit Funds:

The growth of private credit funds may contribute to the availability of mezzanine financing options for companies seeking alternative sources of capital.

5. Innovation in Structures:

Ongoing innovation in mezzanine financing structures may lead to new and creative solutions that better align with the financing needs of businesses.

Conclusion

In conclusion, mezzanine financing stands as a dynamic and strategic option for companies seeking capital to fuel growth and achieve strategic objectives.

Welcome all of you to my website. I keep updating posts related to blogging, online earning and other categories. Here you will get to read very good posts. From where you can increase a lot of knowledge. You can connect with us through our website and social media. Thank you