what is Liquidity: Liquidity refers to the ease with which an asset or security can be bought or sold in the market without causing a significant impact on its price.

In simpler terms, it measures how quickly an asset can be converted into cash or cash-equivalent assets.

Liquidity is a crucial aspect of financial markets, influencing the efficiency and functionality of buying and selling transactions.

- 1 The Significance of Liquidity | What is Liquidity

- 1.1 1. Market Efficiency: The Lifeblood of Trading

- 1.2 2. Price Stability: Balancing Supply and Demand

- 1.3 3. Cost of Transactions: Navigating Trading Costs

- 1.4 4. Risk Management: Ensuring Accessibility

- 1.5 5. Market Sentiment: Reflecting Investor Confidence

- 1.6 Metrics for Measuring Liquidity

- 1.7 1. Bid-Ask Spread: Gauging Transaction Costs

- 1.8 2. Volume of Trading: Assessing Market Activity

- 1.9 3. Market Depth: Analyzing Order Book

- 1.10 4. Turnover Ratio: Evaluating Trading Activity

- 1.11 5. Immediacy: Time to Execute Trades

- 1.12 Impact of Liquidity on Financial Instruments

- 1.13 1. Stocks: The Equity Marketplace

- 1.14 2. Bonds: Fixed-Income Dynamics

- 1.15 3. Forex Market: The Currency Exchange

- 1.16 4. Cryptocurrencies: Digital Assets

- 1.17 5. Derivatives: Futures and Options

- 1.18 Challenges and Considerations

- 1.19 1. Market Impact: The Price of Illiquidity

- 1.20 2. Market Drying Up: Flash Crashes and Liquidity Evaporation

- 1.21 3. Market Manipulation: Vulnerability in Thinly Traded Assets

- 1.22 4. Shifts in Liquidity: Adapting to Changing Conditions

- 1.23 Future Trends in Liquidity

- 1.24 1. Digital Innovation: Blockchain and Tokenization

- 1.25 2. Algorithmic Trading: Navigating the Algorithmic Landscape

- 1.26 3. Globalization: Interconnected Financial Markets

- 1.27 Conclusion

The Significance of Liquidity | What is Liquidity

1. Market Efficiency: The Lifeblood of Trading

Liquidity is the lifeblood of financial markets. It facilitates smooth and efficient trading, allowing investors to enter or exit positions with minimal impact on the asset’s price.

2. Price Stability: Balancing Supply and Demand

Liquid markets tend to exhibit greater price stability. When there is a balance between buyers and sellers, large transactions are less likely to cause significant price fluctuations.

The cost of buying or selling an asset is influenced by its liquidity. In liquid markets, transaction costs are generally lower because there is a greater pool of buyers and sellers.

4. Risk Management: Ensuring Accessibility

Liquidity plays a crucial role in risk management. Investors and traders value assets that can be easily converted to cash, providing a means to respond to unforeseen circumstances or changing market conditions.

5. Market Sentiment: Reflecting Investor Confidence

Liquidity can be an indicator of market sentiment. In times of uncertainty, markets may experience reduced liquidity as investors become more cautious, impacting the ease of trading.

What is Balance Sheet? Dafination, Features & Importance

What is Diversification? Principles, advantages & Challenges

What is ROI? Significance, factors & Challenges

Metrics for Measuring Liquidity

1. Bid-Ask Spread: Gauging Transaction Costs

The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A narrower spread generally indicates higher liquidity.

2. Volume of Trading: Assessing Market Activity

The volume of trading reflects the total number of shares or contracts traded in a given period. Higher trading volumes often correlate with higher liquidity.

3. Market Depth: Analyzing Order Book

Market depth measures the quantity of buy and sell orders at various price levels. A deep market with substantial orders on both sides indicates higher liquidity.

4. Turnover Ratio: Evaluating Trading Activity

The turnover ratio compares the total trading volume to the market capitalization of an asset. A higher turnover ratio suggests higher liquidity.

5. Immediacy: Time to Execute Trades

Immediacy measures the time it takes to execute a trade. In more liquid markets, trades can be executed quickly, while less liquid markets may experience delays.

Impact of Liquidity on Financial Instruments

1. Stocks: The Equity Marketplace

Liquidity is paramount in the stock market. Blue-chip stocks of large, well-established companies often exhibit high liquidity, attracting a broad range of investors.

2. Bonds: Fixed-Income Dynamics

Liquidity is a critical consideration in the bond market. Government bonds and those issued by highly-rated entities are often more liquid than bonds from lower-rated issuers.

3. Forex Market: The Currency Exchange

Liquidity is a defining feature of the foreign exchange (forex) market. Major currency pairs, such as EUR/USD and USD/JPY, are highly liquid, allowing for seamless trading.

4. Cryptocurrencies: Digital Assets

Liquidity in the cryptocurrency market varies. Major cryptocurrencies like Bitcoin and Ethereum are generally more liquid than smaller altcoins, impacting their tradability.

5. Derivatives: Futures and Options

Liquidity is crucial in derivatives markets. Highly liquid futures and options contracts allow for efficient hedging and speculation strategies.

Master the Basics of Finance for professionals Video Course

Business Finance Essentials Fundamental Concepts with Tutorial

Financial Ratios Practical guide For finance students

What is Financial Intelligence Basic Course with Video

Challenges and Considerations

1. Market Impact: The Price of Illiquidity

Illiquid markets can experience more significant price impacts from large trades. Investors may struggle to execute trades at desired prices, leading to increased transaction costs.

2. Market Drying Up: Flash Crashes and Liquidity Evaporation

In extreme cases, markets can experience flash crashes where liquidity evaporates rapidly. This can result from sudden market events, algorithmic trading, or a combination of factors.

3. Market Manipulation: Vulnerability in Thinly Traded Assets

Thinly traded assets are more susceptible to market manipulation. Illiquid markets may be more easily influenced by a small number of large trades.

4. Shifts in Liquidity: Adapting to Changing Conditions

Liquidity conditions can change, influenced by economic events, regulatory changes, or shifts in market sentiment. Investors need to adapt to evolving liquidity dynamics.

Future Trends in Liquidity

1. Digital Innovation: Blockchain and Tokenization

Innovations such as blockchain technology and tokenization have the potential to reshape liquidity in financial markets.

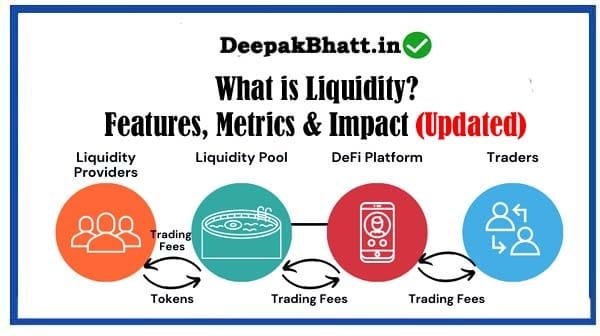

Digital assets and decentralized finance (DeFi) platforms may introduce new avenues for liquidity.

The rise of algorithmic trading continues to impact liquidity dynamics. As automated trading systems become more prevalent, understanding algorithmic strategies becomes crucial for market participants.

3. Globalization: Interconnected Financial Markets

Globalization is contributing to increased interconnectivity among financial markets.

Liquidity conditions in one part of the world can influence markets globally, necessitating a more comprehensive approach to liquidity management.

Conclusion

In conclusion, liquidity is a cornerstone of the financial markets, influencing the efficiency, stability, and accessibility of trading.

Understanding the intricacies of liquidity is essential for investors, traders, and financial professionals navigating the ever-evolving landscape of finance.

As markets continue to evolve and new technologies emerge, liquidity remains a critical aspect that shapes the dynamics of buying and selling, influencing investment decisions across diverse financial instruments.