EBITDA In the realm of finance and business, acronyms abound

Is one that frequently makes its way into discussions about a company’s financial health.

Stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. This metric serves as a key indicator of a company’s operational performance and financial viability.

In this comprehensive guide, we’ll delve into the intricacies, exploring its definition, calculation, significance, and limitations.

Liquidity Risk: Impact, Role & Challenges

What is the Sharpe Ratio? Definition, Formula

- 1 I. Understanding : Breaking Down the Acronym (EBITDA)

- 1.1 1. Earnings:

- 1.2 2. Before:

- 1.3 3. Interest:

- 1.4 4. Taxes:

- 1.5 5. Depreciation:

- 1.6 6. Amortization:

- 1.7 II. Calculating : The Formula Unveiled

- 1.8 III. Significance : Why It Matters

- 1.9 1. Operational Performance:

- 1.10 2. Comparative Analysis:

- 1.11 3. Investment Decision-Making:

- 1.12 4. Valuation Metric:

- 1.13 IV. Limitations : Proceeding with Caution

- 1.14 1. Exclusion of Essential Expenses:

- 1.15 2. Ignores Capital Expenditure:

- 1.16 3. Varies Across Industries:

- 1.17 4. Susceptible to Manipulation:

- 1.18 V. Adjusted: Fine-Tuning the Metric

- 1.19 1. Normalizing for Irregularities:

- 1.20 2. Non-Cash Charges:

- 1.21 3. Debt Repayment Considerations:

- 1.22 VI. EBITDA vs. Operating Income: Understanding the Differences

- 1.23 1. Depreciation and Amortization:

- 1.24 2. Tax and Interest:

- 1.25 3. Use in Different Contexts:

- 1.26 Conclusion

I. Understanding : Breaking Down the Acronym (EBITDA)

Write Better Emails: Team Communication

Practical Leadership Skills: A Guide To Leadership

1. Earnings:

Earnings refer to a company’s profits, specifically the revenue generated minus the cost of goods sold (COGS).

2. Before:

Looks at the financial picture before accounting for interest, taxes, depreciation, and amortization.

3. Interest:

Interest represents the cost of borrowing for a company. It’s excludes this to focus solely on operational performance.

4. Taxes:

Taxes, both income and other taxes, are excluded from it, to isolate operating performance.

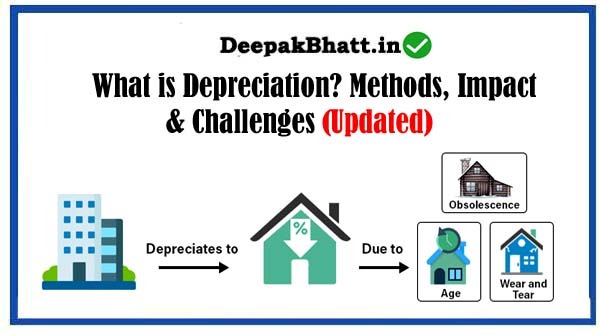

5. Depreciation:

Depreciation accounts for the decrease in the value of physical assets over time. Adds it back to earnings.

6. Amortization:

Amortization involves spreading the cost of intangible assets over time. Adds this back to earnings as well.

II. Calculating : The Formula Unveiled

Formula is straightforward:

EBITDA=NetIncome+Interest+Taxes+Depreciation+Amortizationortization

However, more commonly, EBITDA is calculated as:

EBITDA=OperatingRevenue−operating expenses

Operating expenses here include items like salaries, rent, utilities, and other costs directly related to a company’s core operations.

III. Significance : Why It Matters

1. Operational Performance:

It’s provides a snapshot of a company’s operational performance by focusing on core earnings before various financial factors.

2. Comparative Analysis:

Enables easier comparison of companies across industries and sectors, as it removes the impact of different tax rates, capital structures, and accounting methods.

3. Investment Decision-Making:

Investors often use EBITDA to assess a company’s profitability and make informed investment decisions.

4. Valuation Metric:

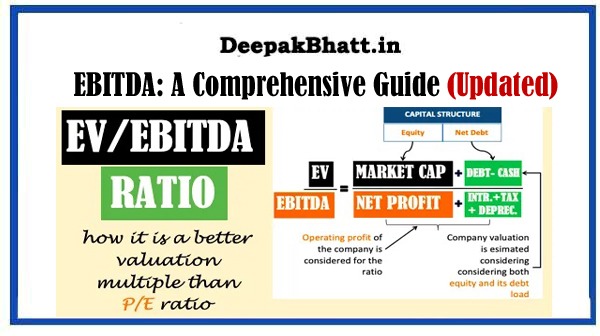

It is a key component in various financial ratios and valuation metrics, such as the EBITDA multiple, used in company valuations.

IV. Limitations : Proceeding with Caution

1. Exclusion of Essential Expenses:

Critics argue that EBITDA excludes critical expenses, such as interest and taxes, providing an incomplete financial picture.

2. Ignores Capital Expenditure:

Does not consider capital expenditures, which are essential for a company’s long-term sustainability and growth.

3. Varies Across Industries:

It’ s utility can vary across industries, and its application may not be suitable for all sectors.

4. Susceptible to Manipulation:

Some argue that EBITDA can be manipulated, as it allows companies to present a more favorable financial image by excluding certain expenses.

V. Adjusted: Fine-Tuning the Metric

1. Normalizing for Irregularities:

Involves normalizing the metric by accounting for irregular or one-time expenses that may distort the true operational performance.

2. Non-Cash Charges:

Companies may exclude non-cash charges from EBITDA to present a more accurate picture of their cash flow.

3. Debt Repayment Considerations:

Adjusted EBITDA may factor in changes in debt repayment schedules to reflect a more realistic financial scenario.

VI. EBITDA vs. Operating Income: Understanding the Differences

1. Depreciation and Amortization:

- The primary difference lies in the treatment of depreciation and amortization. Operating income includes these expenses, while EBITDA adds them back.

2. Tax and Interest:

- Operating income deducts taxes and interest, whereas EBITDA leaves them out of the equation.

3. Use in Different Contexts:

- Often favored for assessing overall company performance while operating income is used for analyzing the profitability of specific business segments.

Conclusion

Serves as a valuable metric in financial analysis, offering insights into a company’s operational performance. However, it’s crucial to approach EBITDA with a nuanced understanding, recognizing its limitations and potential for manipulation.

When employing EBITDA in financial assessments, consider the specific context, industry dynamics, and the company’s unique circumstances. Additionally, be open to using adjusted EBITDA when irregularities may distort the metric.