Mutual Funds Embarking on the journey of investing requires a nuanced understanding of financial instruments, and mutual funds stand out as a popular and versatile option.

- 1 A Comprehensive Guide to Mutual Funds

- 1.1 Chapter 1: Unveiling the Basics

- 1.2 What is a Mutual Fund?

- 1.3 Types of Mutual Funds

- 1.4 Advantages and Risks

- 1.5 Advantages

- 1.6 Risks

- 1.7 Chapter 2: Navigating the Mutual Fund Landscape

- 1.8 How to Invest in Mutual Funds

- 1.9 Step 1: Choose Your Investment Goal

- 1.10 Step 2: Assess Your Risk Tolerance

- 1.11 Step 3: Fund Selection

- 1.12 Step 4: Expense Ratios

- 1.13 Mutual Fund Costs

- 1.14 Front-end Load

- 1.15 Back-end Load

- 1.16 Expense Ratio

- 1.17 Chapter 3: Advanced Strategies for Mutual Fund Investors

- 1.18 Tactical Asset Allocation

- 1.19 Market Timing

- 1.20 Sector Rotation

- 1.21 Tax-Efficient Investing

- 1.22 Tax-Loss Harvesting

- 1.23 Qualified Dividend Income

- 1.24 Systematic Withdrawal Plans (SWP) and Systematic Investment Plans (SIP)

- 1.25 SWP

- 1.26 SIP

- 1.27 Chapter 4: Monitoring and Review

- 1.28 Regular Portfolio Review

- 1.29 Performance Evaluation

- 1.30 Rebalancing

- 1.31 Staying Informed

- 1.32 Economic Indicators

- 1.33 Fund Manager Changes

- 1.34 Conclusion

A Comprehensive Guide to Mutual Funds

Whether you’re a novice seeking to comprehend the basics or an adept investor in search of advanced strategies, this comprehensive guide is designed to illuminate the intricate realm of mutual funds.

Discretionary Income: A Comprehensive Guide

Earnings Per Share (EPS): A Comprehensive Guide

Chapter 1: Unveiling the Basics

What is a Mutual Fund?

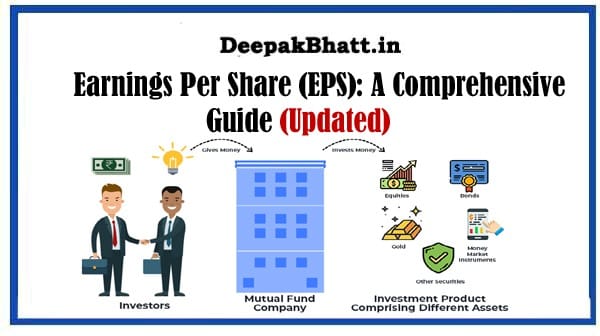

At its core, a mutual fund is a collective investment vehicle that pools funds from numerous investors to create a diversified portfolio.

This portfolio typically includes an array of stocks, bonds, or other securities, providing investors access to a professionally managed investment portfolio without requiring significant initial capital.

Types of Mutual Funds

Equity Funds:

Aimed at capital appreciation, equity funds primarily invest in stocks, making them suitable for those seeking long-term growth.

Debt Funds:

Focused on fixed-income securities like bonds, debt funds offer regular income through interest payments and are considered lower-risk compared to equity funds.

Hybrid Funds:

Also known as balanced funds, these strike a balance between stocks and bonds, catering to investors looking for a mix of growth and income.

Index Funds:

With a passive management approach, index funds replicate the performance of a specific market index, offering investors a straightforward way to mirror market trends.

Sector Funds:

These funds concentrate on specific sectors such as technology or healthcare, allowing investors to target industries they believe will outperform the broader market.

Advantages and Risks

Advantages

Diversification:

Mutual funds spread risk across various assets, mitigating the impact of poor-performing individual investments.

Professional Management:

Expert fund managers make investment decisions, offering valuable insights for investors who may not have the time or expertise to manage their own portfolios.

Liquidity:

Mutual funds provide liquidity, enabling investors to buy or sell shares easily on any business day, adding a layer of convenience to the investment process.

Risks

Despite these advantages, investors must be aware of potential risks, including market fluctuations, economic downturns, and the inherent risks associated with specific investment types.

With the basics in place, let’s delve into navigating the dynamic landscape of mutual funds.

How to Invest in Mutual Funds

Step 1: Choose Your Investment Goal

Define your investment goal—whether it’s growth, income, or a balanced approach—laying the foundation for selecting the most appropriate mutual funds.

Step 2: Assess Your Risk Tolerance

Understanding your risk tolerance is crucial. This assessment helps determine the optimal mix of funds that aligns with your comfort level.

Step 3: Fund Selection

Research and choose funds that align with your investment goals, considering factors such as past performance, fund manager experience, and the fund’s expense ratio.

Step 4: Expense Ratios

Be mindful of expense ratios, as lower fees can positively impact your overall returns. The expense ratio represents annual fees as a percentage of assets.

Mutual Fund Costs

Front-end Load

Some mutual funds charge a front-end load, a fee imposed at the time of purchase, typically as a percentage of the investment amount.

Back-end Load

Another fee is the back-end load, charged when redeeming shares. This fee may decrease over time, encouraging long-term investment.

Expense Ratio

Expressed as a percentage of assets, the expense ratio covers ongoing management fees, administrative expenses, and operational costs.

Chapter 3: Advanced Strategies for Mutual Fund Investors

For those seeking to elevate their mutual fund investment approach, advanced strategies can provide an edge.

Tactical Asset Allocation

Market Timing

Adjusting your investment allocation based on market conditions is known as market timing. Investors employing this strategy believe they can anticipate market changes for optimal returns.

Sector Rotation

This strategy involves shifting investments among different sectors based on economic or market trends. The goal is to capitalize on the outperformance of specific sectors during different economic phases.

Tax-Efficient Investing

Tax-Loss Harvesting

Offsetting capital gains with capital losses by strategically selling investments in a loss position can help reduce tax liability.

Qualified Dividend Income

Choosing funds with tax-efficient dividend distributions can minimize the tax impact on your income, as qualified dividends are taxed at a lower rate than ordinary income.

Systematic Withdrawal Plans (SWP) and Systematic Investment Plans (SIP)

SWP

For those seeking a regular income stream, a Systematic Withdrawal Plan involves periodically selling a specific amount of mutual fund units.

SIP

A Systematic Investment Plan allows investors to contribute a fixed amount at regular intervals, regardless of market conditions. This disciplined approach aids in cost averaging and mitigating market volatility.

Chapter 4: Monitoring and Review

To ensure the longevity and success of your mutual fund investments, regular monitoring and reviews are paramount.

Regular Portfolio Review

Performance Evaluation

Assess your mutual funds’ performance against relevant benchmarks to gauge how well your investments are faring compared to the broader market.

Rebalancing

Market fluctuations can alter your portfolio’s asset allocation over time. Periodic rebalancing ensures that your investments align with your risk tolerance and original goals.

Staying Informed

Economic Indicators

Stay abreast of key economic indicators such as interest rates, inflation, and unemployment rates. Understanding these factors is crucial for making informed investment decisions.

Fund Manager Changes

Keep a vigilant eye on any changes in the fund’s management team, as shifts in leadership can impact the fund’s strategy and performance.

Conclusion

Investing in mutual funds offers a rewarding journey with options for investors at every level. Whether you’re a beginner or an experienced player, tailor your investments to your financial goals and risk tolerance.

Remember, investing is a long-term commitment, and success often comes from a well-thought-out strategy and disciplined execution. Happy investing!