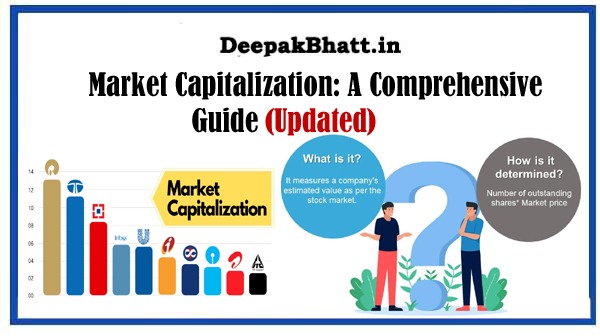

Market capitalization, often referred to as “market cap,” is a fundamental metric that serves as a heartbeat for investors

Offering insights into a company’s size, value, and overall standing in the financial markets.

This comprehensive guide aims to unravel the intricacies of market capitalization, its calculation, significance, and its role in investment decision-making.

Elevating Security Awareness: A Comprehensive Guide

Mastering Collaboration: Work Together Best Results

Discretionary Income: A Comprehensive Guide

- 1 I. Defining Market Capitalization

- 1.1 1. Definition:

- 1.2 2. Equation:

- 1.3 II. Understanding Market Cap Categories

- 1.4 1. Large Cap:

- 1.5 2. Mid Cap:

- 1.6 3. Small Cap:

- 1.7 4. Micro Cap and Nano Cap:

- 1.8 III. Significance of Market Cap in Investment Analysis

- 1.9 1. Risk and Return Potential:

- 1.10 2. Market Index Representation:

- 1.11 3. Investment Style and Strategy:

- 1.12 IV. Market Cap vs. Enterprise Value

- 1.13 1. Market Cap:

- 1.14 2. Enterprise Value:

- 1.15 V. Market Cap and Stock Price Movements

- 1.16 1. Impact of Stock Splits and Buybacks:

- 1.17 2. Stock Price and Market Cap Relationship:

- 1.18 VI. Challenges and Considerations

- 1.19 1. Volatility and Risk:

- 1.20 2. Liquidity Concerns:

- 1.21 VII. Market Cap in a Global Context

- 1.22 1. Global Market Cap Rankings:

- 1.23 2. Technology and Innovation Impact:

- 1.24 VIII. Conclusion: Navigating the Financial Landscape with Market Cap Knowledge

I. Defining Market Capitalization

1. Definition:

- Market capitalization is the total value of a company’s outstanding shares of stock, calculated by multiplying the current stock price by the total number of outstanding shares.

2. Equation:

- Market Cap = Current Stock Price × Total Outstanding Shares

II. Understanding Market Cap Categories

1. Large Cap:

- Large-cap companies typically have a market capitalization of over $10 billion. These are often well-established, stable corporations with a history of strong performance.

2. Mid Cap:

- Mid-cap companies fall within the range of $2 billion to $10 billion in market capitalization. They are considered to have moderate growth potential and risk.

3. Small Cap:

- Small-cap companies have a market capitalization between $300 million and $2 billion. They are often characterized by higher growth potential and higher volatility.

4. Micro Cap and Nano Cap:

- Companies with market capitalizations below $300 million are categorized as micro-cap, while those below $50 million are sometimes referred to as nano-cap.

III. Significance of Market Cap in Investment Analysis

1. Risk and Return Potential:

- Market cap is often associated with risk and return potential. Large-cap stocks are generally perceived as lower risk but with lower growth potential, while small and micro-cap stocks may offer higher growth potential but come with higher risk.

2. Market Index Representation:

- Market capitalization plays a crucial role in determining the composition of market indices like the S&P 500, where larger companies have a more significant impact on the index’s movements.

3. Investment Style and Strategy:

- Investors often align their investment styles and strategies with different market cap categories. For example, value investors may seek opportunities in large-cap stocks, while growth investors may focus on smaller companies.

IV. Market Cap vs. Enterprise Value

1. Market Cap:

- Market cap reflects the total equity value of a company, representing the market’s perception of the company’s worth.

2. Enterprise Value:

- Enterprise value considers not only the market cap but also a company’s debt and cash holdings, providing a more comprehensive view of its total value.

V. Market Cap and Stock Price Movements

1. Impact of Stock Splits and Buybacks:

- Stock splits and buybacks can impact a company’s market cap without necessarily reflecting a change in its intrinsic value.

2. Stock Price and Market Cap Relationship:

- Changes in a company’s stock price directly influence its market cap. A rising stock price increases market cap, and vice versa.

VI. Challenges and Considerations

1. Volatility and Risk:

- Small and micro-cap stocks can experience higher volatility, making them riskier investments. Investors should carefully assess risk tolerance.

2. Liquidity Concerns:

- Stocks with smaller market caps may have lower liquidity, potentially leading to challenges in buying or selling shares at desired prices.

VII. Market Cap in a Global Context

1. Global Market Cap Rankings:

- Investors often compare the market capitalizations of companies and stock markets globally to gauge the relative size and influence of different regions.

2. Technology and Innovation Impact:

- The rise of technology and innovation has seen the emergence of large-cap tech companies dominating global market capitalization rankings.

In conclusion, market capitalization serves as a vital metric in the world of finance, providing a snapshot of a company’s size and market standing. Understanding the significance of market cap categories, their implications for investment strategies, and the challenges associated with different market caps empowers investors to make more informed decisions in navigating the dynamic financial landscape.

So, whether you’re a seasoned investor or a newcomer to the stock market, incorporating market capitalization knowledge into your investment analysis toolkit enhances your ability to make strategic and informed investment choices. Happy investing!